Owned by PayPal since 2013, Venmo has become one of the most popular peer-to-peer (P2P) platforms for requesting money and making payments. As of 2023, there are tens of millions of individual Venmo users, as well as more than two million Venmo business profiles in operation.

With so many people embracing the service for their everyday payments, incorporating the Venmo platform into your digital wallet may seem like an easy call. But there’s always the lingering question of whether Venmo is truly safe to use. With that in mind, join us as we cover everything you need to know about common Venmo scams and how to keep your personal information safe while using the Venmo app.

What Is Venmo, and How Does It Work?

When creating your Venmo account, you’ll be prompted to link the app to your bank account. If you intend to offload your Venmo balance, you can transfer funds from the app to that linked account. Though you can leave your funds on the app, the Consumer Financial Protection Bureau (CFPB) warns against the practice. Transferring funds off of the app can help users avoid some common Venmo scams and keep their money safe.

Is Venmo Safe and Secure for Sending Money?

The platform uses advanced encryption to protect user login credentials and account information, as well as monitoring tools designed to help detect fraud. Additionally, like some other top P2P platforms, Venmo is insured by the Federal Deposit Insurance Corporation (FDIC) and regulated by the federal government, greatly diminishing any counterparty risk.

Nevertheless, no app is completely immune to cyber threats. Therefore, it’s important to routinely check your account for suspicious activity and adhere to the CFPB’s recommendation, making sure to avoid leaving large amounts of money in your Venmo account at once.

What Are the Most Common Venmo Scams to Watch Out For?

These crimes aren’t unique to Venmo, as they unfortunately occur across all P2P platforms at varying frequencies, but below are some scams that are common to the app:

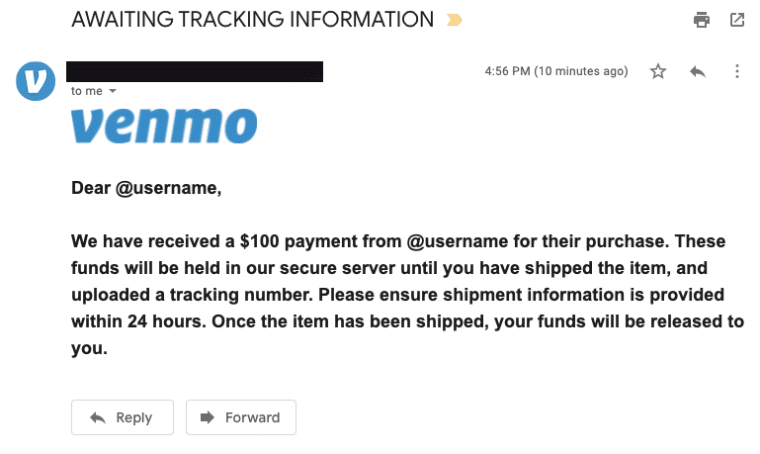

Fake Payment Notifications

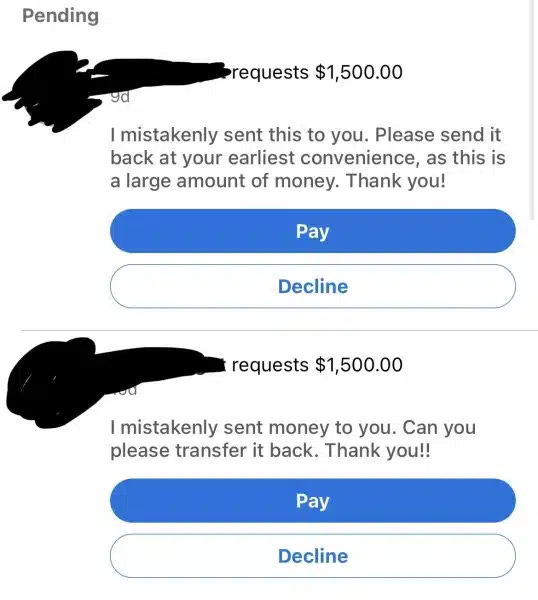

Overpayment and Refund Scams

It may sound like a simple and honest mistake, but there’s just one problem: The overpayment came from a stolen account. That means the scammer will make off with the refund while you’re out of whatever you just paid them.

Requesting Outside Payment

One of the most common Venmo scams involves being asked to make an off-platform payment. If someone contacts you via the Venmo app only to ask you to make a payment elsewhere, don’t do it. Be especially wary if they send you any suspicious links instead of just forwarding you their username or email for the other platform. In such cases, that “other platform” is very likely fake and intended solely to steal your money.

Venmo Text Scams

Sometimes, hackers will send you a text telling you to log into Venmo so they can pay you. And just like the ones mentioned above, these links are usually fraudulent, too. If you click on any of them and enter your login credentials, the hacker may be able to access your account at any time.

Should I Give Venmo My SSN?

Receiving a request for your Social Security Number (SSN) should make you suspicious. However, it’s important to remember that Venmo (and other P2P payment platforms) are, in fact, legally required to ask for your SSN in accordance with certain government regulations. These laws are designed to combat money laundering and tax fraud.

Based on recent legislative changes, PayPal, Venmo, and other P2P platforms must collect users’ SSNs for reporting purposes if they receive $600 or more in funds for goods and services. This rule primarily applies to businesses, but you may meet this criteria as an individual user as well if you have a high volume of payments.

If you do meet the requirements, Venmo will require your SSN to send you a Form 1099-K at the end of the year. You will have to claim any earnings listed on the 1099-K when you file your taxes. However, if you are just using Venmo to split restaurant bills or pay back friends (and not to sell goods or services), you won’t need to worry about this.

Tips to Stay Safe and Avoid Scams When Using Venmo

The abundance of potential Venmo scams can seem overwhelming, but there are several effective tips and best practices to know about that will protect your Venmo login details and avoid scams. These include the following:

Only Send Money to Venmo Friends

If you use Venmo for personal purposes, only send money to people you know in real life. Don’t send money to strangers unless you’ve taken steps to vet them.

Also, never assume a request for money is real if it’s only made through the app. For example, if a good friend suddenly asks you to send them a large sum of money, call or text them to verify that they actually made the request.

Create a Strong Password

Don’t use a generic password, and never reuse the same login credentials across multiple apps. It’s also essential to enable multi-factor authentication, which requires you to pass at least two checks to access your account, such as entering a password and then providing a code sent to you via text. Offline MFA methods like Google Authenticator are even more secure than SMS-based MFA, but both make your account much safer.

Be Wary of Suspicious Requests

If you get a weird message from an entity claiming to be a member of Venmo support, be on your guard. Always check the full email address and ensure it is consistent with Venmo’s standard email format, as fraudsters will often use spoof email addresses. These have display names that appear legitimate, but their actual addresses will link to a different server altogether. Watch out for requests to log in to your account, and try not to click links in the email. Navigate to Venmo.com instead (or use the app).

When in doubt, contact Venmo directly using their live chat or phone options. They can affirm whether the message is legitimate and help give you peace of mind. However, never call the phone number or email listed in the suspicious email. Make sure to go to Venmo.com directly and use their help center to contact them.

Review Your Privacy Settings

A shocking 88% of data breaches are linked to human error. Even a seemingly small mistake can expose your private information to bad actors and compromise your account. As such, you should periodically review your privacy settings and ensure you aren’t sharing too much information.

Contact Venmo Support Immediately if You’ve Been Scammed

If all else fails and you fall victim to a scam, contact Venmo support right away. They may be able to lock your account or freeze your funds before any bad actors can make off with them.

How to Use Venmo Safely and Securely as a Business

As with other digital wallet apps, you can use Venmo to drive more sales by removing barriers to transactions. However, it’s vital that you take the necessary precautions to protect your business and customer data.

Here are a few tips that we’ve learned by examining past data breaches:

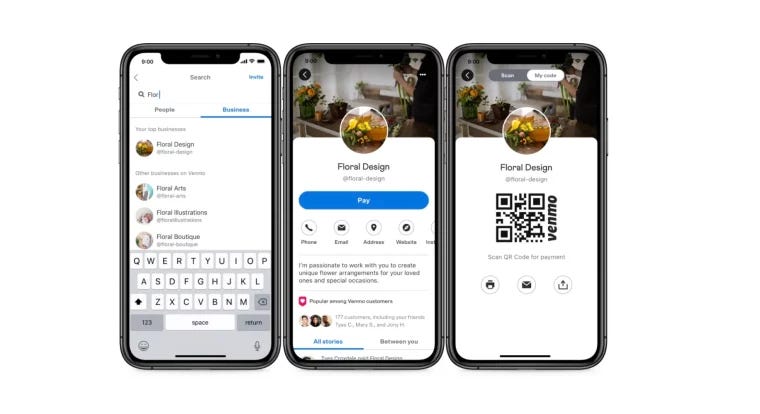

Create a Business Profile

If you intend to use Venmo at your company, create a business profile. These accounts offer additional benefits, features, and protections designed to allow you to accept payments professionally.

At the same time, though, keep in mind that adding Venmo to your list of accepted payment methods can also add a layer of complexity to managing your finances. As such, you should ensure there is a strong demand for the service before creating a business Venmo account.

Explain Your Refund Policies

While disputes might not be common, it’s important to be prepared for them, just in case an issue arises. The last thing you want is to lose out on hundreds in revenue while an unscrupulous customer makes off with your products.

To that end, you must establish clear and fair refund policies and clearly state what you’re selling. If a customer disputes a transaction with Venmo, the app’s support team will defer to your stated policies.

Consider Using a Business Credit Card

If you’re worried about linking your primary bank account to Venmo, consider using a business credit card for your transactions instead. Doing so offers an extra layer of protection and limits the likelihood of fraudsters accessing your business accounts.

Choose a card provider that offers fraud monitoring and other alerts. The sooner you discover and report suspicious activity, the greater your ability to mitigate the impacts. Additionally, it’s much easier to contest fraudulent credit card charges than it is to recover funds stolen from your bank account.

Take Advantage of Venmo Purchase Protection

If you have a professional account, you’ll be able to take advantage of the Venmo Purchase Protection Program. While you’ll have to pay a small fee for the service, it will protect you against fraud claims, payment reversals, and many other types of scams.

Keep Your Accounts Separate

Whatever you do, do not combine your personal and business funds. If you intend to use Venmo to split checks with friends or send money to loved ones alongside your business, create a separate account. Mixing up professional and personal transactions can cause nightmares, especially during tax season.

Be Mindful of Fees

Like all P2P platforms, Venmo charges fees for business users, and its fee schedule varies depending on the type of payment you accept. If you accept payments from another user’s account, you’ll incur a fee of 1.9% of the payment total + $0.10. Contactless payments incur a 2.29% fee of the payment total + $0.10.

What to Do if You’ve Been Scammed on Venmo

As mentioned above, if you believe you’ve fallen victim to a Venmo scam, your first step should be to contact the company’s support team as soon as possible. Every second that passes increases the odds that the fraudsters will make off with your money. Provide the support agent with details about what happened, including the name of the user who scammed you, the time of the transaction, and any other information you have.

If you’ve already sent the money, it may be difficult to get it back, as the platform transfers funds instantly. But if you report the incident in time and Venmo support freezes the fraudulent user’s account before they remove the stolen funds from the app, there’s still a chance of recovering your money.

After you’ve contacted Venmo, consider reporting the incident to your local police department. You may also want to contact the Federal Trade Commission to report the fraud, as it can provide resources for dealing with it.

Lastly, make sure you change your account password to prevent the fraudster (or anyone else) from re-accessing your account later.

Venmo Alternatives for Secure Digital Payments

While Venmo is a safe platform to use, it’s important to consider alternatives, especially if you are building out your digital wallet for a retail business.

Some other popular P2P payment solutions you may want to check out are as follows:

- Zelle: Offers bank-to-bank transfers with no fees

- Cash App: Similar to Venmo, but provides the option to use debit cards or invest

- PayPal: Venmo’s parent company; great for business transactions

- Google Pay: Built into Android devices; integrates with Gmail

- Apple Pay: Built into iPhone and other Apple devices like the iWatch

There aren’t any right or wrong options here. All of these platforms are secure and user-friendly. It’s about choosing the app that best aligns with your intended use case.

Is Venmo Safe? Yes – Just Be Diligent

No payment app is 100% immune to scams, but Venmo still provides a convenient and safe option for sending money. The key to ensuring your financial safety is being proactive and diligent about suspicious activity. Whether you want to use the platform for personal or business purposes, being mindful of these common scams will allow you to send and receive money on Venmo with confidence.

Thanks for reading! Do you want to create thought leadership articles like the one above? If you struggle to translate your ideas into content that will help build credibility and influence others, sign up to get John’s latest online course “Writing From Your Voice” here.