If you are an aspiring entrepreneur or already at the helm of your own business, then it’s time to brush up on all of the latest financial buzzwords. One concept must add to your tool belt is “payback period.” The payback period reveals how long it will take you to recoup initial investment costs.

A shorter payback period means you’ll break even sooner, which could make a potential investment opportunity more appealing. Conversely, a drawn-out payback period calculation indicates that a particular investment may be more risky.

Learn more about the payback period, including what it is, how it works, and how you can leverage this concept to more effectively manage your business finances.

What Is the Payback Period?

A payback period is a financial metric used to calculate the time it takes for an investment to generate enough cash flow to recover its initial cost. It measures the time it will take you to break even, offering a simple way to evaluate the risk and liquidity of an investment.

The ideal payback period varies depending on several factors, including your risk tolerance and the nature of the investment.

Typically, this metric is expressed in fiscal years. That’s because you’ll usually only crunch the numbers on large investments, not small business expenses. While you do need to track these smaller costs, too, calculating their payback periods is unnecessary.

Generally, a shorter payback period is preferred, as it indicates that you’ll recoup your investment costs sooner. In turn, this reduces your risk exposure.

There are other financial concerns you need to factor in. While useful, the payback period isn’t effective in a vacuum. Here are some related concepts that will help you better understand the concept better.

Other Concepts You Need to Know

When calculating your payback period, you need to know about cumulative cash flows. This metric tracks the total cash you receive from an investment over time, which reveals when your initial costs have been recovered.

After you’ve reached the payback period, you can begin tracking the cumulative net cash flow, which is how much an investment earns after your initial costs.

Some other terms to know include:

- Initial Investment: The starting capital you put into an investment, such as equipment, business space, or software

- Net Present Value (NPV): Evaluates the profitability of an investment by discounting future cash flows to their present value

- Discounted Cash Flow: A method that factors in the time value of your money

- Average Annual Cash Flow: Estimates how evenly the investment generates returns

Getting to know these concepts will make it easier to accurately calculate and track your progress toward a payback period. Keep in mind that you don’t need to track it for every business investment. For instance, there’s no need to run payback period calculations on a second monitor for your computer that only costs a few hundred dollars (unless your budget is incredibly tight).

Instead, you should use the payback period when evaluating the viability of large investments. Some examples include purchasing a new fleet vehicle, investing in costly software, or signing a multi-year office lease.

How to Calculate the Payback Period

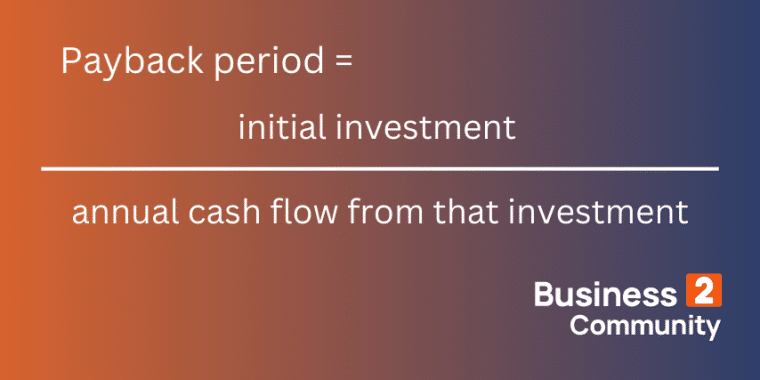

It’s time to crunch some numbers. You can calculate an investment’s “payback period” by using this simple formula:

For instance, suppose that your business invests $50,000 in a new project and expects to generate $10,000 annually. Here’s how those figures fit into the payback period formula.

Payback period = $50,000/$10,000

Payback period = 5 years

Do those margins make sense for your business? That’s up to you to decide. If you are considering two or more investment options, compare their payback periods. You should always consider the opportunity costs too, not just which option will break even sooner.

Opportunity cost considers the benefits you’ll miss out on when choosing one option over a different one. For instance, it weighs the missed opportunities associated with buying a new work vehicle vs. upgrading your software.

Suppose that another investment option also costs $50,000 but the payback period is just four years. At first glance, option two sounds like the better investment. However, if that investment involves launching a new product with a life cycle of just five years, you’ll earn positive returns for only one year after you’ve recouped your upfront costs.

As you can see, calculating the payback period can get complicated in a hurry. You’ve got to consider how long each investment will continue yielding returns, how many years it takes to break even, and what opportunities you are passing up to follow through on your plan.

Perhaps the trickiest part involves estimating your rate of return. While you aren’t going to be 100% accurate on this estimate, you need to be fairly close. Being off by thousands of dollars can skew your calculations and expose you to significantly more risk.

What Is a Good Payback Period?

There aren’t any hard and fast rules when it comes to payback periods. The ideal timeframe to recoup your money varies by industry and investment type due to different capital outlays, expedited returns, and risk levels.

However, there are a few scenarios where there are clear limits to a payback period. You might need to calculate it for a large investment to make sure that you will have enough cash flow when a large interest payment comes due, for example.

Generally speaking, shorter payback periods are preferred, as they indicate you’ll break even much sooner. As a result, you’ll enjoy less financial risk and improved liquidity.

However, you can’t use the payback period as your sole tool for evaluating investment decisions. You need to consider factors like the project’s total return, cash flow patterns, and potential impacts on your company’s broader financial strategy. Also, make sure to evaluate alternative investment opportunities that can position your business for long-term growth.

Discounted Payback Period

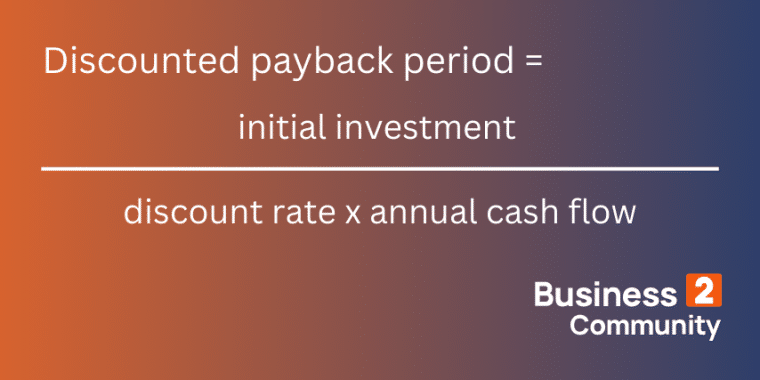

The traditional payback period calculation overlooks the time value of money to some extent. You can address this limitation by using the discounted payback period. This method discounts future cash flows to their present value before calculating how long it will take to recover the initial investment.

While this approach provides a more accurate assessment of the investment’s profitability, it also introduces added complexity. Specifically, you have to determine the appropriate discount rate.

Despite these challenges, the discounted payback period offers a valuable perspective for comparing investments with a more precise understanding of their financial implications.

Advantages of Using the Payback Period

There are lots of perks associated with calculating how long it will take you to break even on an investment. Specifically, business owners value this tool for the following reasons:

1. Simplicity

This calculation is incredibly simple, provided you can accurately estimate your annual rate of return. Once you know that, all you need to do is divide the initial investment by your return rate. Within a couple of minutes, you’ll have a good idea of how many years it will take to break even.

2. Focus on Cash Flow

Cash flow is one of the most important components of a successful business. You need strong, stable cash flow to cover your expenses and keep your company afloat. The payback period formula solely prioritizes the cash flow of a particular investment, allowing you to understand how it impacts your bottom line.

3. Ability to Gauge Risk

While the payback period is not a precise measurement, it does provide a good estimate of investment risk.

For example, if a new project will involve an initial investment of $100,000 and will take five years to break even, you can quickly determine whether that time frame aligns with your risk tolerance. If it doesn’t, you can move on to other opportunities.

4. Usefulness as a Screening Tool

The payback period calculation functions as a great screening tool when comparing multiple opportunities. You can quickly rule out impractical investments and focus on more pragmatic options.

Limitations of the Payback Period

The payback period calculation does have some serious shortcomings:

1. Ignores Cash Flows After the Payback Period

The biggest flaw with this method is that it ignores what happens after you break even. Therefore, you need to consider what sort of return an investment will offer once you’ve paid back your initial costs.

2. Doesn’t Account for the Time Value of Money

As discussed previously, the payback period doesn’t account for the time value of your money. However, you can remedy this shortcoming by using the discounted calculations.

3. Lacks Clear Decision Criteria

This calculation simply reveals how many years it will take to break even. It doesn’t have any criteria for comparing one payback period to another. For example, suppose that one investment is set to return its initial cost in four years and another has a five-year break-even point. Both require $50,000 in capital.

Which one is the better option? You won’t learn that from the payback period. Instead, you will need to determine things like the total return, asset lifecycle, etc.

4. Doesn’t Measure Total Return

Speaking of total return, that’s another variable that the payback period doesn’t account for.

Consider the four-year and five-year investment options. The four-year investment yields a return of $12,500, which makes it more appealing at first glance. However, suppose that this investment has a life cycle of only six years. The other investment has a return of $10,000 per year and has a life cycle of ten years.

While the payback period is a year longer, you’ll also benefit from more profitable years. This illustrates why you need to consider multiple factors before settling on a particular investment.

Payback Period Examples

Now, see how you can apply this concept in a few different scenarios.

First, consider a purchase of manufacturing equipment that involves a $100,000 upfront cost. These upgrades yield an additional $25,000 in net annual profit. Therefore, the payback period is four years.

In a second example, suppose that instead of purchasing equipment, you want to invest in a rental property that costs $200,000 and generates $20,000 annually after expenses. In this instance, your payback period is 10 years.

Comparing these investments can be tough, as there are so many variables at play. However, if you can tolerate the added risk and have the capital to take on a larger upfront expense, the rental property likely represents the better investment.

That’s because the machinery will eventually need to be replaced. While the house will need repairs and upgrades, its total value will increase, whereas the equipment loses value with age.

Tips for Using the Payback Period

When using the payback period, you’ve got to consider other financial metrics so you can examine the big picture. Compare investments with different cash flows very carefully, and be mindful of irregular or variable returns that may impact your calculations.

Most importantly, set a threshold for what you consider to be an acceptable payback period based on your risk tolerance and investment goals. You should ask yourself, “How long can I stand to be without this money?” For example, if you set four years as your limit, don’t entertain investments with a five-plus year break-even period.

Also, consider the time value of money by using the discounted payback period calculations. This is especially important when exploring opportunities that will take five or more years to break even.

Lastly, consider the inherent risk of each investment. Shorter payback periods often indicate lower risk.

Using the Payback Period to See the Bigger Picture

The payback period represents an excellent tool for making investment decisions and calculating risk. However, you need to combine it with other assessment tools to make informed choices and protect yourself from undue risk. Some of these include the Sortino ratio, the Treynor ratio, the operating ratio, and more.

By leveraging these concepts, you can make wise investment decisions and effectively evaluate the long-term implications of how you spend your capital.

Thanks for reading! Do you want to create thought leadership articles like the one above? If you struggle to translate your ideas into content that will help build credibility and influence others, sign up to get John’s latest online course “Writing From Your Voice” here.