One of the most infallible measures of your company’s profitability is its gross margin. Calculating and analyzing your gross margin can give you clearer insights into how well your business is performing. It’s a vital metric to constantly keep an eye on and try to improve to drive greater profits and business success.

In the following guide, you’ll learn more about your gross margin, its significance, and how it relates to your other business metrics.

What Is Gross Margin?

Your company’s gross margin indicates the difference between its revenue and the cost of goods sold (COGS). The latter includes the direct production costs and any indirect costs associated with product creation. Sometimes called “gross profit margin,” it is a metric that aids businesses in evaluating their operational efficiency and financial strategies.

However, there is a distinction between gross profit and gross profit margins. Gross profit simply refers to the absolute amount a company earns after deducting its COGS. Gross profit margin, in contrast, reflects the percentage of revenue that exceeds the COGS. Therefore, gross profit is measured in dollars and gross profit margins are expressed as percentages (and are, as such, also referred to as “gross margin percentages”).

Best Practices for Using Your Gross Profit Margin

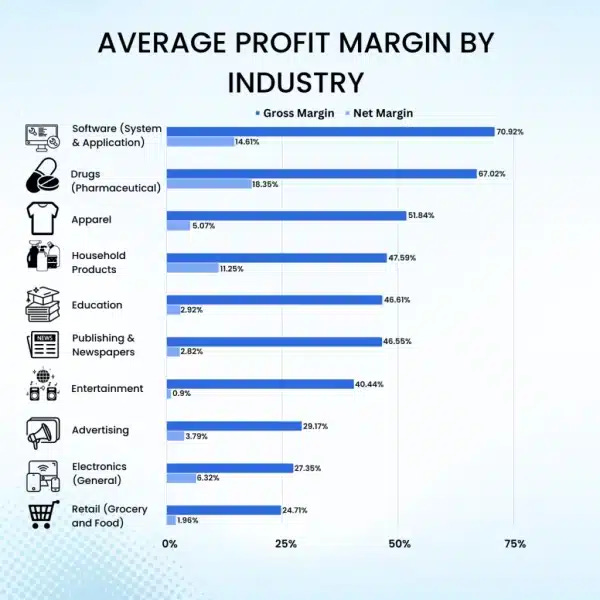

Keeping a close eye on gross margins is vital for businesses across many industries, including manufacturing, retail, and food production. Software developers, healthcare industries, and financial services tend to have higher gross margins than others, but they can still use the metric to monitor business performance.

Business leaders can use gross margins in one of several key ways:

- To compare their businesses to industry benchmarks

- To optimize their pricing strategies

- To reduce their COGS

- To adjust their business strategies

Together, these practices can help you refine your business and advance into the future.

When Is Gross Margin Analysis Most Critical for Businesses?

The following situations can be ideal times to use a gross margin calculator to measure the efficiency of your business:

- When trying to assess the impact of inflation on profits

- When making decisions about how to allocate company resources

- When determining the return on investment (ROI) of a new product or service

- When evaluating your core business strategy and setting new goals

- When providing a snapshot of your business to lenders or investors

When you need to secure new funding for your business, lenders will want to see your gross margin alongside several other core business metrics. Preparing your gross margin can increase your chances of securing a favorable small business loan.

How to Use Gross Margin

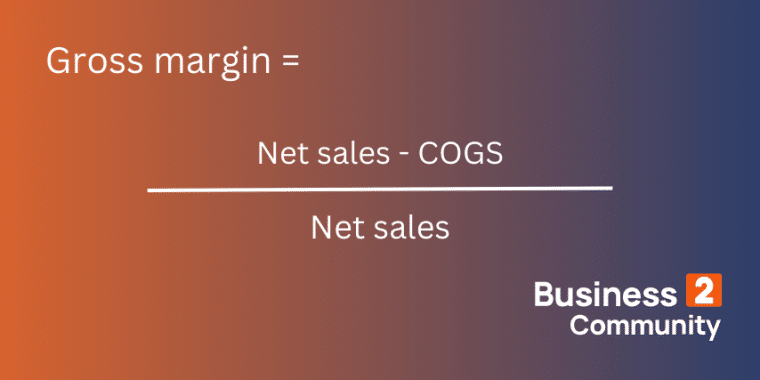

You don’t need to be a math whiz to calculate gross margins. Aside from using a gross margin calculator, you can simply use the following formula to determine your gross profit margin:

Gross margin = (Net sales – COGS) / (Net sales)

The following guide will help you learn how to use this formula in your business setting:

Calculating Your Gross Margin

As an example, imagine that your company earns $30,000 in net sales but spends $20,000 on the COGS. Applying the formula, you can calculate your gross margin as follows:

Gross margin = ($30,000 – $20,000) / ($30,000)

In this case, your gross margin would be roughly 33%. If you are a retailer, that would exceed the industry benchmark of 24.27%. Thus, your gross margin might point you toward adjusting your price point to be more competitive.

Interpreting Your Gross Margin

Fully understanding what your gross margin says about your business means adopting some common interpretation strategies.

You can derive insights about your business performance by doing the following:

- Comparing your gross margin to industry benchmarks, as seen in the example above

- Evaluating your operational and production costs to increase your gross margin

- Assessing your current pricing strategies

- Tracking your gross margin over time to see how production costs impact profits

That last suggestion might be especially useful for growing businesses. Ideally, you’ll want to see your gross profit margin rise with time. A declining profit margin may indicate problems in your production model or supply chain, which may require a new strategy.

Practical Applications for Gross Margin Analysis

Consider two scenarios where the gross margin becomes significant for your business decisions.

In the first, you calculate your gross profit margin and discover that your profit margins are unusually high for your industry. That seems great (and it certainly could be) but if it doesn’t match up with greater-than-average gross profits, it may indicate that your selling price is too high. A high selling price naturally yields a greater profit margin but may limit your sales volume. Adjusting your price point can help you compete with other businesses and generate more revenue through higher sales.

In the second scenario, you discover that your gross margin is lower than current industry standards or your prior years’ data. That may point to a higher COGS, which may reflect the cost of production itself or the indirect costs associated with distribution. Therefore, a low gross margin may prompt you to reevaluate your supply chain or procurement process to bring costs down and improve your gross margin.

Examples of Calculating Gross Margin

How does gross margin impact businesses in the real world? Consider the following two examples that illustrate the importance of gross profit margin.

Case Study 1: New Startup

First, consider the case of Theresa’s newly-launched business, which manufactures and sells athletic wear. Her total sales revenue for the year came to $120,000, but after subtracting discounts and fees, her net sales fell to $95,000. Meanwhile, her COGS came to $85,000.

Theresa inputs her figures into the gross margin formula and determines that her gross margin is:

Gross margin = ($95,000 — $85,000) / ($95,000)

In other words, Theresa’s gross margin comes to a scant 10.5%. Most retail businesses see a gross margin of 24.47% or better. Comparing herself to that industry benchmark, Theresa was compelled to raise the price of some of her best-selling apparel while adjusting her marketing strategy to emphasize the value her customers receive.

Case Study 2: Large Enterprise

DigiGraphics is a software company that provides software-as-a-service for small to midsize businesses. Each year of operation, the company reviews its income statements and sales figures and calculates its gross profit margin. The company’s net sales totaled $150,000 this year, while its COGS had fallen to just $45,000.

Thus, its gross profit margin came to the following:

Gross margin = ($150,000 — $45,000) / ($150,000)

That means the company had achieved a high gross margin percentage of 70%. Most software companies aim for a gross margin of 58.58%.

The high margin gave DigiGraphics room to introduce a new pricing tier for entry-level customers, allowing the company to provide more value to certain customers. Doing so may have dropped their gross margin, but it allowed them to onboard more first-time users.

Gross Margin vs. Net Margin

Gross and net margins can both be used to evaluate a company’s profitability, but these metrics have some key differences. Gross margin reflects the company’s revenue remaining after accounting for the COGS. On the other hand, a net profit margin reflects your net income after accounting for all business expenses such as taxes, interest on debt, and other operating costs.

Strategic Implications of Net Margin Over Gross Margin

As you can see, net profit margins offer a far more comprehensive picture of company operations. Businesses can, therefore, use their net margins to evaluate the performance of the companies as a whole. A low net margin, for example, might cause a company leader to evaluate more than just their COGS and work toward eliminating debt or reducing their tax burden through strategic deductions.

Using Gross Margin Over Net Margin

Your gross margin will be more helpful in evaluating the true profit percentage of your core sales activities. But when you want to zoom in on the efficiency of your pricing model, gross margin is generally the ideal choice. However, if you want to evaluate the financial performance of your business more holistically, net margin will incorporate more data.

Tips to Optimize Gross Margin

Optimizing your gross margin demands the right strategy. With that in mind, business leaders can attenuate their gross profit margin using one of the following categories of techniques:

Cost Management Techniques

When your gross margin falls above industry benchmarks, you might take steps to manage costs, such as:

- Sourcing materials from new suppliers

- Negotiate for lower material costs

- Diversifying your supply chain to reduce shipping costs

- Outsourcing assembly or production

- Relying on more affordable materials

Just make sure not to reduce your material costs in a way that harms the quality of your product, as that could result in lower sales in the long term.

Price Optimization

Business leaders should usually work toward optimizing their prices to align their gross margins with industry standards. For example, raising the price of your products can ensure a stable gross margin, though you may need to ensure that consumers understand how the quality of your products justifies the new price point. Check out the average gross margin and net margin of some of the largest industries below.

Alternatively, you could lower your prices to remain competitive. You may see your profit margins decrease (while staying within industry standards), but you will likely achieve a higher sales volume overall.

Process Improvement Initiatives

Another way to optimize your gross margin is through process improvement initiatives designed to address the indirect COGS. You might consider how logistics partners might lower costs by outsourcing picking, packing, or distribution costs. As another option, you may seek ways to increase production volume to get more of your products onto the market.

Common Pitfalls to Avoid

Despite the benefits of your gross margin, it’s important not to overlook additional variables that can impact your final numbers. These include things like:

Overlooking Variable Costs

Your COGS won’t always reflect a fixed cost. Supply chain delays and changes in the price of supplies can radically alter the final amount. Ignoring these variables can alter your gross margin data and distort your view of your company’s profitability.

Ignoring Market Dynamics

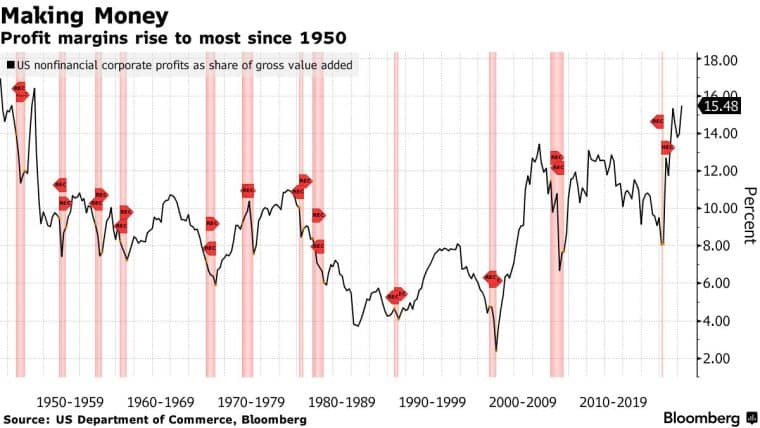

Market trends can radically alter your gross margin. Sales volume and customer sentiment can change over time, and some products may experience cyclical consumer trends. These dynamics can result in different gross margins over a single year. In fact, profit margins of US nonfinancial companies have nearly doubled in just the last few years according to a recent Bloomberg report.

Short-Termism vs. Long-Term Value

Today’s gross margin doesn’t always predict tomorrow’s success. Making small adjustments can improve your gross margin, but you must also remain focused on your long-term business strategy. Keeping an eye on your gross margin alongside other metrics will help you maintain a holistic view of your business now and in the future.

Pay Close Attention to Your Gross Margin

Data drives your best decisions, and analyzing and optimizing your gross margin can keep you in the driver’s seat of your business. Thinking in terms of gross margin can help you understand your profitability and sales efficiency. Along with the insights and tips provided above, you’ll be able to measure your gross margin and use the data to make well-informed business decisions.

Thanks for reading! Do you want to create thought leadership articles like the one above? If you struggle to translate your ideas into content that will help build credibility and influence others, sign up to get John’s latest online course “Writing From Your Voice” here.