How to Harness Efficiency Ratios to Boost Business Performance

Have you tested your company’s success with an efficiency ratio (or multiple efficiency ratios)? “How successful is your business?” might sound like a straightforward question, but there is a boatload of different metrics you can use to quantify how successful (or unsuccessful) a given business is.

When you need to take a close look at a given business’s performance, it’s essential to know how to take large amounts of financial data and boil it down to insights you can act on. One of the best ways to do this is to use efficiency ratios. Here’s our full guide to efficiency ratios, showing you how you can best use them to improve your business’s profitability and success.

What Is an Efficiency Ratio?

Efficiency ratios measure a company’s ability to use its resources to make a profit or maximize its operations. There are multiple specific efficiency ratios that are used to gauge and track various important financial metrics. Depending on the types of insights you need, you can calculate an inventory turnover ratio, accounts payable turnover, asset turnover ratio, and more.

Here’s how to calculate the most important efficiency ratios that you should be using.

How to Calculate Efficiency Ratios

The best way to truly understand the usefulness of efficiency ratios is to learn about all of the most useful kinds of efficiency ratios, how to calculate them, and what types of insights they can give you. Here are the main ratios you should know.

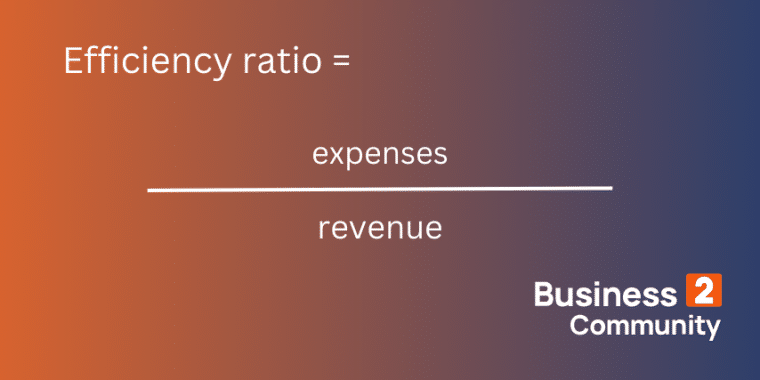

Basic Efficiency Ratio

Efficiency ratios can be useful for calculating very specific insights. However, they also can be used to give you a quantifiable, big-picture look at your business’s overall efficiency.

The basic efficiency ratio is one of these. It measures a business’s total expenses against its total revenue. The calculation looks like this:

This basic ratio is most commonly used for banks. In general, a basic efficiency of 50% or less is considered optimal. Don’t worry if you don’t know what to do with your ratio yet. We’ll dive into exactly how to analyze these ratios later on.

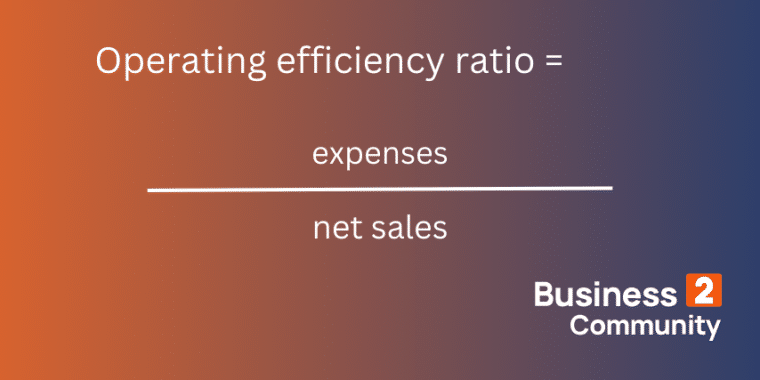

Operating Efficiency Ratio

This ratio examines how efficiently a company’s spending produces revenue. To calculate it, you need to know your business’s net sales and expenses. Make sure you include the cost of goods sold (COGS) in your expenses. Here’s what the calculation looks like:

The operating efficiency ratio is often known by other names. You might hear it called an operational efficiency ratio or an operating ratio. Just like with a basic efficiency ratio, you want this ratio to be as low as possible, but it should be 50% at most.

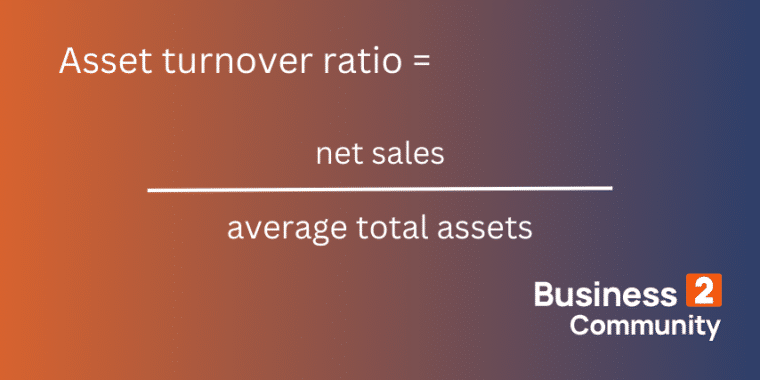

Asset Turnover Ratio

Wondering how well your business is using the assets it has to drive sales? This ratio will tell you how. Here’s how you calculate it:

Note: You can calculate average total assets by averaging the business’ total assets for the current year and its total assets for the previous year.

What constitutes a “good” ratio? That depends on the sector. In retail, a ratio of 2.5 or more is a good sign. However, in the world of utilities, an average ratio of more than 0.5 is virtually unheard of. Ultimately, a higher asset turnover ratio is better.

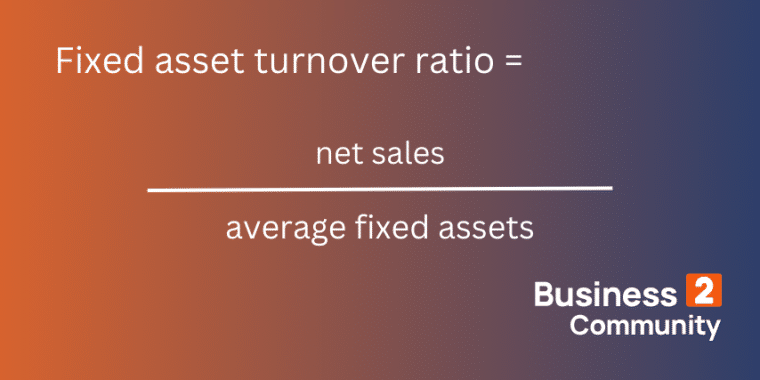

Fixed Asset Turnover Ratio

This ratio is similar to an asset turnover ratio. However, it only considers long-term fixed assets. These are assets that your business holds and uses for over a year. Some examples include machinery, buildings, software, furniture, and any equipment used in the manufacturing process. Here’s how you calculate this ratio:

In this case, a higher ratio is better. A high ratio means that your business is able to use its long-term assets efficiently to generate revenue.

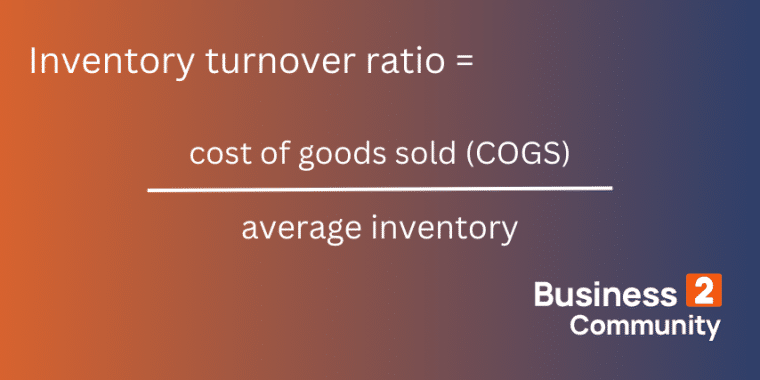

Inventory Turnover Ratio

If your business involves sales, you know that you don’t want your inventory sitting on your shelves indefinitely. The faster you move inventory, the better your chances of generating a respectable profit.

The inventory turnover ratio gives you an easy way to assess how well you’re moving inventory. Here’s how to calculate it:

Note: COGS = Starting inventory + purchases − ending inventory

There’s not a specific number you should shoot for for this metric. Instead, the higher the ratio, the better your sales. However, you can compare your inventory turnover ratio to similar businesses to see how you stack up with competitors.

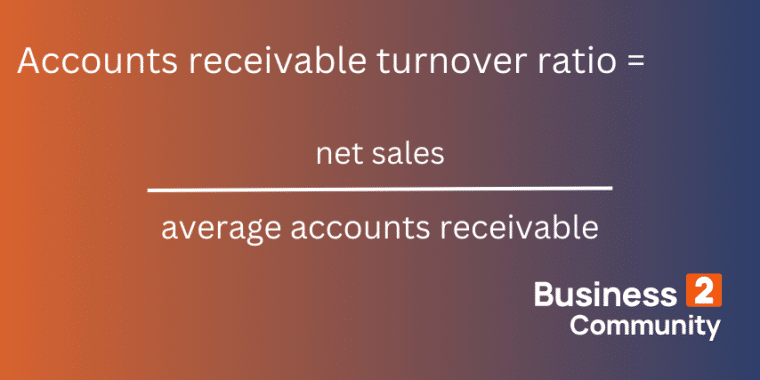

Accounts Receivable Turnover Ratio

This ratio is sometimes called a “debtors’ turnover.” That’s because it tells you how effective a company is at collecting payments from customers (by the expected deadlines). Here’s how to calculate this ratio over a given period of time:

The higher this ratio, the better. You might wonder how businesses end up with low ratios in the first place. That’s because some businesses will sell on credit and give their customers time to pay the bill. Customers usually have 30 days to pay, although some businesses may extend that time.

If a company needs to raise its accounts receivable turnover ratio, one of the best ways to do so is to reduce net credit sales, or sales made on credit.

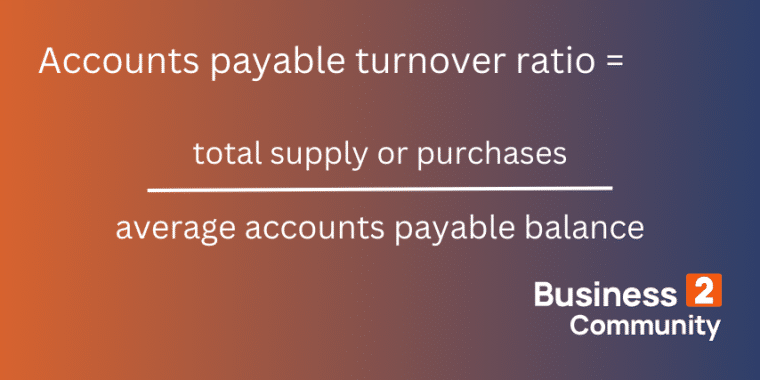

Accounts Payable Turnover Ratio

This ratio is somewhat similar to the accounts receivable turnover ratio. Instead of measuring how quickly a business’s customers pay, it measures how quickly a business pays its suppliers. Here’s how to calculate it:

A higher accounts payable turnover ratio is better. When your business is able to quickly repay debts, it generally indicates that it’s in good financial health. If your company’s ratio starts to decrease, it might indicate that there are developing financial issues you should examine.

When Should I Use Efficiency Ratios?

Efficiency ratios are valuable tools for anyone involved in running a business (and sometimes for prospective investors too). Here are a few instances where they’re especially useful:

- Any time you need to get an accurate sense of a company’s performance

- When you’re looking for ways to optimize your business

- When conducting regular financial reviews

- During strategic planning sessions

For the best and most consistent results, regularly calculate efficiency ratios. When you frequently evaluate your business’s performance this way, you’ll be able to spot any emerging problems before they significantly affect your company.

Practical Application of Efficiency Ratios

You now have a general overview of some of the most common efficiency ratios. However, if you want to get the most out of these valuable tools, you need to know how and when to apply them. Here’s a look at how to use efficiency ratios in practice.

Choose the Right Ratio

First, you need to select an efficiency ratio that lines up with what you currently want to focus on. For example, if you’re trying to better manage your inventory, an inventory turnover ratio is the best one to use

Calculate and Interpret Results

Once you have the required data, actually calculating efficiency ratios is very straightforward. However, that calculation is meaningless if you don’t know how to interpret the results.

For example, when you’re calculating a basic efficiency ratio, a lower number is better. If you’re under the mistaken assumption that you need a high efficiency ratio to be successful, you might make business decisions that actually lead your company in the wrong direction.

Once you know which direction you need to take the business, it’s time to use that information to help improve it.

Use the Results in Future Decisions

If you have a clear idea of what an efficiency ratio is communicating to you, you can use that data to guide strategic decisions. For example, if your basic efficiency ratio is higher than you thought, you might start looking at what expenses you can cut.

If you have a high inventory turnover ratio, it might show you that you’re managing your inventory effectively. However, if the ratio is too high, it might indicate that you’re frequently running out of stock before replenishing your inventory.

All you need to do is to find the variable (or variable) that seems to be the culprit of your business woes. From there, you can work out targeted solutions to get to the root of the problem instead of wasting resources on less impactful changes.

Real-World Examples of Efficiency Ratios at Work

Understanding efficiency ratios, in theory, is one thing. But if you want to grasp how they can deliver critical insights and guide business decisions, it’s best to consider a real-world example.

For instance, imagine a retail startup that conducts a thorough review of its operations every year. The startup is especially interested in its inventory management (like all retail companies should), so it should use this calculation:

Inventory turnover ratio = cost of goods sold/average inventory value

In year one, the startup determined that the cost of goods sold was $450,000, and the average inventory value was $400,000. It calculated its inventory turnover ratio:

Inventory turnover ratio = $450,000/$400,000 = 1.25

In the retail sector, a good inventory turnover ratio is about 2.5, so the startup needs to make some adjustments. It decreases the amount of inventory it has on the shelves and lowers prices slightly. In year two, the calculation looks like this:

Inventory turnover ratio = $550,000/$200,000 = 2.75

As you can see, the retail startup has more than doubled its inventory turnover ratio. This puts it in a good place for the sector. So, should the company keep trying to speed up inventory turnover?

Not necessarily. Moving a certain amount of inventory is helpful, but you might not want so much of your capital tied up in inventory. However, if inventory turnover is too high, that generally means that you don’t have adequate inventory to meet demand. That can cost you a considerable amount in lost sales.

One of the best ways to strike a balance between adequate stocking and adequate turnover is to use trusted inventory management software. For the startup, this kind of software might be a worthwhile investment. The software can ensure it’s ordering enough to maximize sales without overstocking.

Efficiency Ratios: An Essential Part of Any Entrepreneur’s Toolkit

Efficiency ratios are more than just metrics. When you know how to choose your ratio, calculate it, and correctly interpret results, you’ll find that efficiency ratios serve as beacons of light guiding your entrepreneurial journey.

If you’re looking for other ways to measure the success of your business, check out our guides on principle component analysis, cohort analysis, discourse analysis, and CVP analysis.

When you regularly use efficiency ratios and other important measures of success to evaluate your business, you’ll be able to make the right decisions to optimize your business operations and keep your company moving closer to sustained profitability.

Thanks for reading! Do you want to create thought leadership articles like the one above? If you struggle to translate your ideas into content that will help build credibility and influence others, sign up to get John’s latest online course “Writing From Your Voice” here.