Finding an Online CPA to Help You Meet the New July 15th Tax Filing Deadline

By George Birrell of Taxhub

The following is a sponsored content post.

Due to the global pandemic, extended closures for businesses, and a generally drastic change in lifestyle for most if not all of us, the Treasury Department and Internal Revenue Service extended the time period for U.S. taxpayers to file tax returns.

The deadline changed from April 15th to July 15th in an attempt to give everyone the chance to still file while hopefully obtaining their refund quickly. Moreover, policymakers hoped it would give people time to gather the money needed if they owe taxes.

Even with the extended deadline, the IRS urges taxpayers who anticipate a refund to file electronically as soon as possible. This is because filing electronically and setting up a direct deposit is considered the quickest way to get your refund.

There are plenty of apps and online services to help you with taxes or any questions about the process. Those services give you access to a Certified Public Accountant (CPA). That’s a trusted advisor who helps individuals and businesses plan and reach their financial goals. A good CPA will guide you through these processes.

The Benefits of Working With an Online CPA

In order to be ready for the July 15th deadline, consider working with an online CPA. Not only will it be faster, but it may also be cheaper since most of these services charge lower fees than other CPAs.

Taxhub, for example, charges half of what most CPAs do and gives you access to someone with the same expertise as a private accountant. At the same time, Taxhub lets you file from the comfort of your home without complicated guesswork over tax questions.

Moreover, an online CPA with the right technology can offer services to people who couldn’t previously afford traditional access to a CPA. There’s a great balance between tech and live interaction that lets you establish a working relationship with your CPA. You can access their services wherever you are—at home, at the gym, at the park—as long as you have access to an electronic device such as a smartphone, tablet, or laptop. You don’t have to physically travel to a CPA’s office. That’s particularly important nowadays as we are trying to adhere to social distancing guidelines.

The Simpler Way to Gain Access to a CPA

There are currently two ways to gain access to a CPA in preparing and filing your taxes:

- The DIY route with a SaaS product like TurboTax

- The face-to-face route at a mom-and-pop CPA shop or franchise like H&R Block.

However, many people have concluded over the years that there had to be an easier way, one that gets the job done correctly but still makes the processes smoother for taxpayers.

In fact, that is what prompted me to start my business, Taxhub. It’s built on a digital hybrid model that utilizes the best of both traditional options. Our entire business model is based on the most efficient way to deliver a quality tax return. We work for each client based on our super-efficient process that cuts costs and delivers CPA-level tax advice to a previously under-served segment of the market: the self-employed, freelancers, and contractors.

The Taxhub Difference

Our core purpose at Taxhub is to level the tax-world playing field by giving small businesses access to the same expertise that has previously only been available to large corporations. Usually, small businesses and entrepreneurs must go to a small mom-and-pop CPA shop to get quality advice. However, this is inconvenient and costly due to the high overhead most of those CPA firms carry.

That is where we come in. At Taxhub, we offer the same services at lower fees and we do it all online. None of our clients need to leave their businesses or homes to work with us.

An entrepreneur only pays taxes in accordance with his business activity. Consequently, we think it’s unfair for them to have to spend the entirety of their return on a CPA. That is why our services are priced lower; we believe you should be able to enjoy your refund without having to spend most of it on us. Moreover, we allow clients to pay us after their tax returns have been filed. That helps our clients afford the services without worrying about financial struggles.

An Online CPA Offers Time and Cost Savings

With a longer period of time to file taxes, individuals and businesses have had some time and space to think strategically, following the initial shock of the pandemic. It has freed them up to research and look for more accessible and affordable ways to get help during the filing process. Many have discovered the online CPA route and have realized it is a much easier and more cost-effective option. That is why services like Taxhub are a valuable solution. They believe in small businesses and want them to have access to the same level of service that big corporations have always enjoyed.

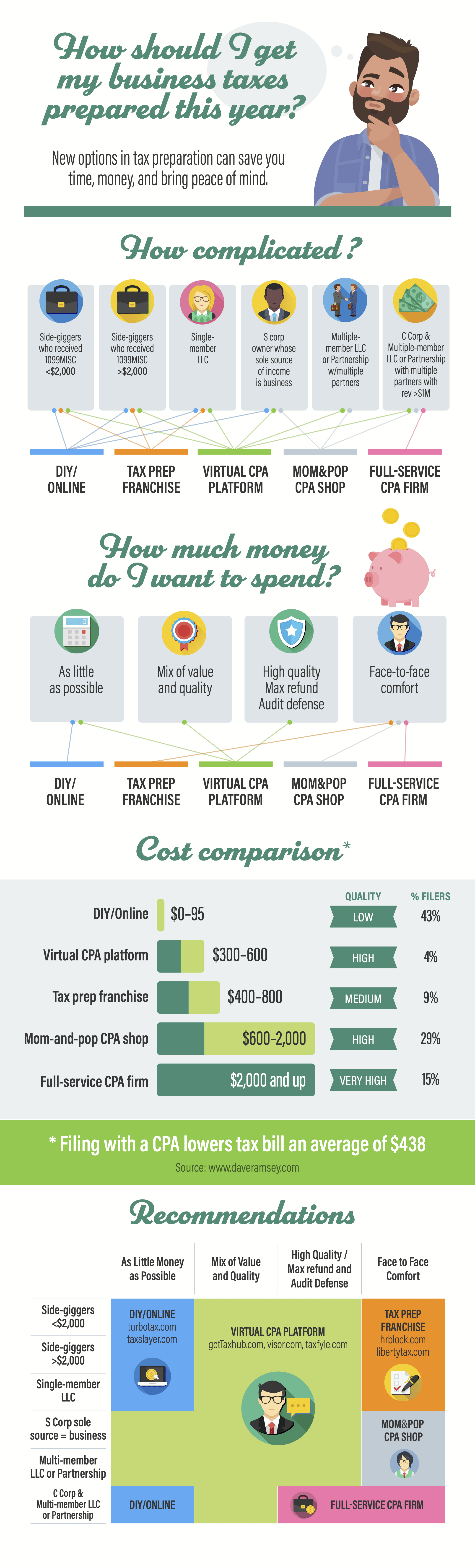

For more information on how you should get your business taxes prepared this year, check out the infographic below.