What is the Snowball Strategy for Paying Off Debt?

Consumer debt continues to grow in the U.S. As of December 2018, total outstanding consumer debt totaled $4.01 trillion, according to data from the Federal Reserve Board. This compares to 2017 when outstanding debt was $3.8 trillion and 2016 when it totaled $3.6 trillion.

Whether buying a home or starting a business, many consumers know they have to reduce debts and improve their credit scores. Otherwise, they may face high interest rates or be denied lending opportunities altogether.

If you’re trying to qualify for a loan, you may feel overwhelmed by the debt you carry. However, you can still stay determined to pay off those debts. You may have a lot to tackle, from credit card debt to student loan debt. No matter the kind of debt you face, you have options to repay those debts in manageable ways.

One popular strategy is the Snowball Effect. Here, we’ll explain this method and how you can make it part of a larger financial strategy.

What is the debt snowball method for paying off debt?

The snowball effect centers around paying off your smaller credit balances before you tackle larger ones. Popularized by Dave Ramsey, the idea is that this approach will help you gain momentum and motivation in your debt repayment. In turn, this will help you pay off debt more quickly.

Ramsey lays out a very simple plan for this method:

- List debts like credit cards, medical bills, car payments and student loans from smallest to largest, regardless of the interest rate. Don’t include your mortgage in this list.

- Make minimum payments on all debts except the smallest debt.

- Pay as much as possible on the smallest debt.

- Once you pay off the smallest debt, start on the next smallest debt. Consider what you were previously paying on the debt you paid off. Now add that to the minimum you were paying on that debt and apply it to what is now your smallest debt.

- Repeat this process until you have paid each debt in full.

The debt snowball method also encourages you to find all the money you can and then put that toward these debts. These funds include payments from extra jobs or money made selling unnecessary items for extra cash.

How the snowball method helps you pay down debt

Here’s an example of the snowball effect, laid out by Ramsey on his site. Say you have $20,000 in debt and the principal amounts and monthly payments look like this:

- $500 medical bill—$50 payment

- $2,500 credit card balance—$63 payment

- $7,000 car loan—$135 payment

- $10,000 student loan—$96 payment

Using this example, you would make minimum payments on everything except the smallest debt, which is the medical bill. You then can apply the $500 you made from a side job to your smallest debt. That $500 plus the $50 minimum payment means you can get rid of the bill in a month rather than over 10 months.

Now, apply that $550 as extra payments each month to the credit card debt along with the $63 minimum payment. That should now only take about four months to pay off.

From there, take the previous amount you were paying on the credit card debt and add it to the $135 car payment. Using this strategy, you’ll have paid off your auto debt in 10 months.

Next comes the biggest debt you have, which is the student loan. Instead of the $96 minimum monthly payment you are making, you’ll have $844 a month to put toward it. The student loan debt should then take about 10 months to pay off.

This strategy gives a person with $20,000 in debt a way to pay off their debts in just 27 months. This is far shorter than the extensive amount of time it would take if you had stuck with minimum payments.

Research backs the snowball strategy

Research has also touted the snowball strategy as an effective way of paying down debt.

A study in the Journal of Consumer Research used anonymous financial data from a period of 36 months to examine how 6,000 debtors paid off their balances. The study concluded that prioritizing one debt over another was more effective than paying a little bit over all debts. In fact, these individuals paid off their debt 15% faster than those making minimum payments.

The research noted the impact was less about math and more about the debtor’s ability to feel a sense of progress along the way. As they saw one balance go down quickly and then disappear, it motivated them to continue to make progress. It helped relieve the sense of overwhelm that people feel around debt.

Comparing debt repayment strategies

The snowball method is just one way of paying off or paying down debt. However, there are several other ways to tackle debt that could be just as effective, if not more. It all depends on what’s right for you. Here are just a few of those alternative strategies:

The debt avalanche

The debt avalanche method involves paying off debts by starting with the highest interest rates, then moving to debts with the lowest interest rates. By eliminating the largest sources of interest first, you can shorten the overall time-to-pay. You can also save money on interest with this method.

The study in the Journal of Consumer Research concluded extremely high-interest debts should receive payments larger than the minimum required. This helps make a case for just how helpful the debt avalanche repayment method is.

A 2018 research paper from James Madison University offered additional conclusions focused on the debt avalanche approach. Researchers conducted an empirical analysis of the Federal Reserve’s Survey of Consumer Finance (SCF) and calculated the time-to-pay for several thousand households’ debts. The goal was to compare and analyze the snowball and avalanche methods.

The research found that the avalanche method was more effective in most cases. Yet, the snowball method performed almost as effectively. Researchers concluded that either strategy can provide financial benefits.

However, the snowball method also offers psychological benefits, such as motivation and the formation of better fiscal habits.

Debt consolidation

Other strategies include debt consolidation. This involves taking out a personal loan the size of your current outstanding debts. These personal loans should have a lower interest rate than some or all of your debts.

With all your debts rolled into a single, lower-interest payment, you can simplify debt repayment at a lower rate. You’ll make one payment a month at a lower interest rate, allowing you to pay off debt more quickly.

But, you have to qualify for that personal loan. Also, this method takes discipline because many want to spend more when they only have one debt on the books. Yet, this third alternative does provide more options to find the right debt repayment strategy for you.

The snowball method’s best application and user

The snowball method may not be ideal for every person. This is especially true for those with credit card debt or multiple types of debt. This method also demands a disciplined fiscal approach that may not be right for everyone.

However, as the examples illustrate, this may be ideal if you’re willing to apply all your extra money to that effort. You should be willing to apply funds toward debt repayment rather than savings or other expenditures.

Tools for snowball debt repayment success

Use tools such as a debt snowball calculator and worksheet to determine whether this method is right for you. Use a snowball spreadsheet and run the numbers to see if this approach works for your debt load. If you use the snowball plan, this tool can track progress visually, which can in turn keep you motivated.

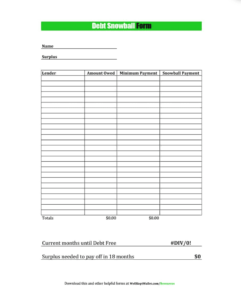

Here’s an example of what a debt snowball worksheet looks like:

A snowball worksheet has numerous columns that help you organize your payment strategy. If it has one, the surplus column represents the money you have left over after your regular expenses you can use to pay down debt.

If there is no surplus, that means you’ll have to either increase income or cut spending.

The next column is the lender column, which lists creditors you need to repay. That’s followed by a column listing the amount owed to each and another for the minimum payment amount. The last column lists the snowball payment. Place these numbers in a snowball spreadsheet so you can update the amount owed column each month to see progress.

The rewards of a snowball debt repayment plan

Once you’ve paid down debts, you’ll have more money available each month to spend or save as you wish. You’ll also be able to build your credit. This can help you get a better interest rate when applying for a mortgage, a vehicle business or personal loan.

You’ll also feel better knowing none of your money is going toward outstanding debt each month. Instead, you can save for the future, create an emergency fund and contribute to your retirement funds. Your money will be your own again, and that’s a satisfying feeling.

Start now

Whether you choose the snowball method, the avalanche method or debt consolidation, you can start working on your debt today. You’ll be closer to financial freedom when you do.

Thanks for reading! My work is almost entirely reader-funded so if you enjoyed this piece please consider sharing it around, liking me on Facebook, following me on Twitter, and maybe throwing some money into my hat on Patreon, Paypal, or with Etherium:. 0X24AC7A8FF92721B9827A03A6936F